Education Loans

Education Loans

Are you considering going to school or sending your kids to college or university? You are probably well aware of the increasingly high costs of post-secondary education. If your kid is going to college or university far from home, the costs could be easily duplicated. Setting tuition aside, you should consider costs for student accommodation (on campus or off-campus, the latter being higher), meals, books and extracurricular fees. Don’t forget about technology costs (mobile, laptop, etc). It quickly adds up.

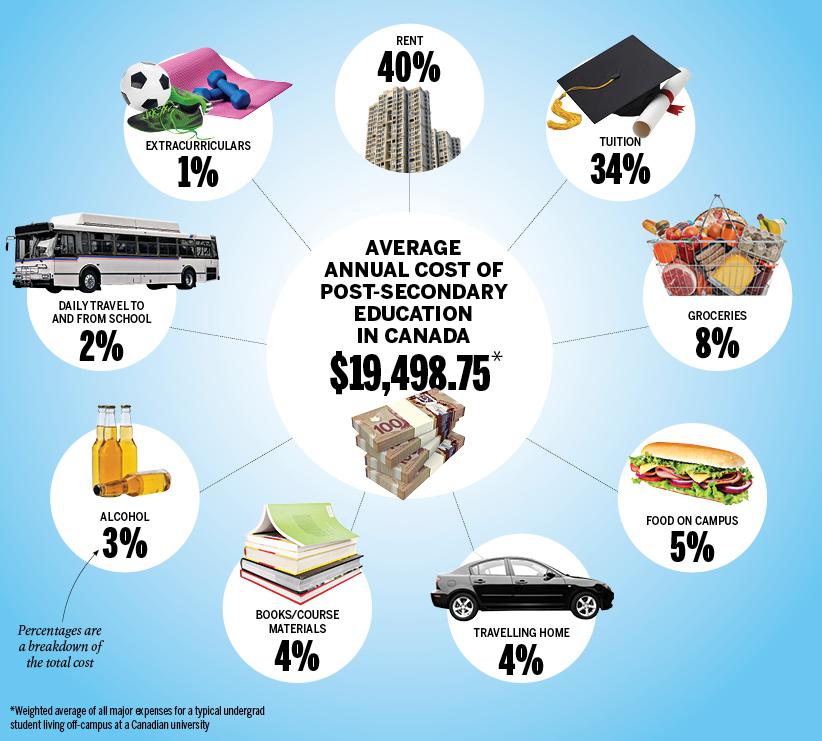

According to a Maclean’s survey, the average cost of a year of post-secondary education in Canada is $19,498.75. But for some students, the amount is significantly higher. A University of Toronto student living off campus can expect to spend $23,485 each year. Second on list was Ryerson at $23,066 followed by Saint Mary’s University in Halifax at $22,892. *

*Source: https://www.macleans.ca/education/what-does-a-university-education-cost-in-canada/

Given these sample figures above, a four year-university degree can cost as much as $60,000. For a child born today, it could cost as much as $140,000 to put them through college or university.

Even if you are considering sending your kids to private school, elementary and secondary school tuition could be even more expensive. Many private schools have tuition starting at under $4,000 per year for elementary years. Tuition for going to a private high school, generally range from $6,000 to $12,000 per year. If you want your kids to attend Ridley College or Upper Canada College, you’ll need to come up with around $35,000 a year. International tuition costs could be even higher.

What financing options are there?

Some people find it easy to put money aside every month through a TFSA (Tax Free Savings Account), or through a RESP (Registered Education Savings Plan); however this is not always feasible for all people. The savings account funds may not be sufficient to cover all educational expenses, or it may need to be complemented by a scholarship or other financial sources.

If you are a home owner, there is another financing option which is right under your roof, and that is your home equity!

Tapping into your home equity to invest in your children’s education could be the optimal solution to get your children through college or university. It will also give you peace of mind to be able to have a nest egg for any additional expenses.

How can I get an education loan?

Here at 911 Mortgage Brokers – The Mortgage Centre, we will help you explore your financial options. Whether it is a lump sum amount to provide you with a large influx of cash, or a solution that provides cash on hand on an as needed basis, our 911 Mortgage Brokers will explore your options with you.

If you are considering getting an education loan, please give us a call at 1-888-377-0911 so we can explain the process and answer any questions you may have.

We will work with you to access the funds needed to launch your children’s education into a successful career and a bright future!