Seniors & Reverse Mortgages

What is a Reverse Mortgage?

A reverse mortgage is a mortgage loan that is available to a homeowner over the age of 55 years and is secured against the available equity in your home. A reverse mortgage allows you to receive up to 55% of the home’s value (excluding the cost of accrued interest). The older you are and the greater the value of your home, the larger the amount you could receive. You (and your spouse, if you have one) must be 55 or over.

Unlike a traditional mortgage or a line of credit, you don’t have to repay a portion of the loan or interest at regular intervals (e.g., monthly). Usually, you repay a reverse mortgage in a single payment when you:

- Move out;

- Sell your home;

- Die (or when you and your spouse die).

Here is an example of how a reverse mortgage can be used:

Jessica and Eric have been retired for a few years now and would like to finance new plans, like travelling, but they don’t have enough money. To get the funds required, they could sell the home they’ve lived in for 40 years, but they still want to live there. With a reverse mortgage, they could continue to own their home, live in it and get the money they need for their plans. They would not have to repay the borrowed amount and the accrued interest until they sold the home.

They could also take out a home equity line of credit, instead, and either repay the loan over time or just pay the interest each month. They’re looking for the best option.

What is a Seniors mortgage?

A Seniors Mortgage is another term for a reverse mortgage that comes with no monthly payment and is offered to a homeowner who is at least 55 years old.

Unlike the regularly most commonly accepted age for seniors being 65 years or greater, for reverse mortgage purposes, a senior is anyone aged 55 years or older. Keep in mind that the older you are, the greater loan-to-value you can qualify for when you apply for a reverse mortgage. It’s important to note that even though often times, a Seniors mortgage is used to carry the costs of retirement, that is not always the case and these mortgages are used for a multitude of purposes. Its benefits can be plentiful.

What are the benefits of a reverse mortgage?

One of the advantages of a reverse mortgages is that it is usually easier to apply and qualify for a reverse mortgage than it is for a traditional new mortgage refinance. In addition to this, there are many other advantages to getting a Reverse Mortgage. Here are a few:

- It’s quick and easy to apply for a reverse mortgage.

- With a reverse mortgage, all of the reverse mortgage funds that you receive are completely tax-free

- There are no restrictions on how and what you may use the funds for. That’s right, with a reverse mortgage you are able to spend the cash that you receive in any way that you desire, and on anything you want.

- In order to receive cash from your home, you don’t need to sell it. You will remain living in your home estate for as long as you like and want to.

- Manage Wealth for themselves and family

- Pay for children’s and grandchildren’s education

- Give an inheritance early to family

- Purchase a vacation home, second home, or cottage

- Purchase investment properties for yourself, children, or grandchildren

- Help you children and grandchildren start building their wealth early

- Pay for homecare and healthcare needs

- No need for an online mortgage payment calculator because there are no monthly mortgage payments to be made. All that you must do is keep paying your property tax, homeowner insurance policy, and maintain the condition of your home.

- Did we mention that you do not have to make any monthly mortgage payment? The only time you need to pay anything back is when you no longer live in your home or when you sell it. At that time the principal and interest payment will be due.

- Since a Reverse Mortgage is classified as a non-recourse loan, you will never be asked to pay back more than the property is actually worth at fair market value provided that you’ve kept it in good condition, made all of your property tax payments, and kept the policy on your homeowner insurance up to date.

- With a Reverse Mortgage you can receive the funds in a few different ways including receiving the entire amount up front in one lump sum payment, or schedule advances that you will receive over a specified period of time.

- A good reverse mortgage plan is typically easier to apply for, qualify for, and receive funds than a traditional mortgage or new home refinance.

- Even if your credit score is low, you might still be able to qualify for a reverse mortgage.

- You don’t need to be earning income to qualify either.

- You can use the borrowed amount to maintain your lifestyle by, for example, paying yourself an annuity.

With so many benefits to the borrowing customer, it’s easy to see why reverse mortgages continue to be a popular choice for homeowners aged 55 or older. Also, the older you are, the more equity you can withdraw from your home with the CHIP plan. With up to 55% loan to value, a reverse mortgage can be a great option for you. The LTV that you can qualify for depends on your age and a variety of other factors that your mortgage broker can use an online reverse mortgage calculator to help you determine how much you can qualify for.

Although reverse mortgages come with an array of benefits, you also need to consider any potential risks that we will look at down below. Contact your mortgage broker by phone or email to see if getting a reverse mortgage is the best solution for your needs or if there may be even better options available to you. A good mortgage broker has the right calculator and all the tools needed to help guide you in the right direction.

What are the disadvantages of reverse mortgages?

Despite all of the good apparent advantages that come along with it it’s important that you are informed about the potential drawbacks of CHIP mortgages. One of the disadvantages of a reverse mortgage is the fact that, since there are no monthly payments to be made on the mortgage, the interest can add up over the years.

Here are a few other common disadvantages and drawbacks that can come along with a reverse mortgage:

- Due to the fact that you, the homeowner, do not end up making monthly mortgage payments, interest rates tend to be higher with a reverse mortgage than with a traditional mortgage refinance through a traditional bank. This is because the lender takes on an increased amount of risk and provides a greater amount of comfort to the customer.

- Another downside to this type of mortgage plan is that since interest is accumulated over time and is added to the principal amount, the balance of your loan increases over the years. The risk with this is that it can leave little to no equity remaining upon repayment of the loan.

Basically, although you or your next of kin will never have to pay back more than the home is worth, provided property tax payments and homeowners insurance policy is maintained, there may not be any money or equity left over in the event of a sale of the home. This will of course depend on a variety of factors including the fair market value of the home once a sale occurs, the length of time and amount of interest that has accumulated the conditions of the real estate properties, and more.

These are all factors that should be considered when deciding if a reverse mortgage plan is right for you.

Our 911 Mortgage Brokers will help you determine if a reverse mortgage is the right option for you.

Are there any restrictions to how I can use the cash received from the reverse mortgage?

Like most home equity loans, reverse mortgages provide tax-free cash proceeds to the borrowers on the date of closing that can be used for whatever the customer desires. Whether it’s to maintain their lifestyle and cover monthly expenses during retirement, help other family members such as your children and grandchildren build their wealth or pay for their education and other expenses, pay-off debt, travel the world, renovate your home, buy a new car, or pay for medical bills, give an early inheritance to someone you love, a reverse mortgage can be a great way to make your dreams come true.

Whether you borrow money through a reverse mortgage, a home equity line of credit or another type of loan, the amounts received are not taxable, because they are a loan, not income.

Am I responsible for any other payments?

The only regular payment that the borrower will be required to make during the term of their reverse mortgage are keeping the property tax paid up to date, and the home and fire insurance. These policy payments might be on a monthly basis or not on a monthly basis depending on the policy of the municipality and homeowner insurance agreement for the specific policy. But never any month to month mortgage payments on their reverse mortgage. If they have any secondary financing behind their reverse mortgage, then they might be required to make payments each month for that 2nd mortgage.

How do I qualify for a Reverse Mortgage?

In order to qualify, the customer borrowing the funds must own a home in Canada and be 55 years of age or older. If the homeowner is married, both spouses must be at least 55 years of age.

The lender will review the following criteria to determine if you would qualify for a reverse mortgage loan that does not come with any monthly mortgage payment obligations, and if so, what amount and loan to value you can qualify for:

- The ages of you and your spouse if you have one and the ages of anyone else who may own your home with you

- The location of your home or estate

- The type of home you own (e.g. detached, condo, townhouse etc.)

- The fair market value of your home at the time when you apply

- What condition your home and estate is in

- How much equity is available in your home. You can find this out using our online home equity calculator.

- Your credit history

How does a reverse mortgage work?

Based on the information above, the lender will determine firstly if you qualify for a reverse mortgage, and secondly what percentage of the value of your home can you withdraw in the form of a reverse mortgage. Depending on which lender you choose and their policy regarding the amortization of loans, you may qualify for more of a loan or less of a reverse mortgage in Ontario based on the individual lender’s sliding scale.

Your age and the appraised value of your home will play a big role in how much equity your will be able to withdraw through a reverse mortgage. The higher your age, the higher the maximum allowed loan to value will be. The lower your age, the lower the maximum allowed loan-to-value will be. Using the appraised value of your home, the higher the current market value is the higher the amount will be based on the loan to value.

For example, let’s say that you are 55 years old and are approved for a loan-to-value of up to 30%. Let’s compare the scenario when your home in Mississauga, Ontario, Canada is worth $850,000 vs your home being worth $500,000.

Home value: $850,000

Maximum LTV: 30%

Maximum reverse mortgage amount = $850,000 x 0.3

Maximum reverse mortgage amount = $255,000

Now let’s look at that scenario with a home worth $500,000

Home value: $500,000

Maximum LTV: 30%

Maximum reverse mortgage amount = $500,000 x 0.3

Maximum reverse mortgage amount = $150,000

Now let’s say those same homes are inhabited by someone who is 70 years of age and qualifies for the full 55% maximum LTV available on a reverse mortgage. Here’s how those scenarios will play out.

Home value: $850,000

Maximum LTV: 55%

Maximum reverse mortgage amount = $850,000 x 0.55

Maximum reverse mortgage amount = $467,500

Now let’s look at that scenario with a home worth $500,000

Home value: $500,000

Maximum LTV: 55%

Maximum reverse mortgage amount = $500,000 x 0.55

Maximum reverse mortgage amount = $275,000

Think of all of the things you can do with the extra money from the equity you pull out of your home! Depending on the lender of your reverse mortgage, you may even be allowed to add a second mortgage behind your reverse mortgage. Also keep in mind that different lenders will have different criteria and stipulations when it comes to allowing secondary financing behind their first position reverse mortgage loan.

How do you pay back a reverse mortgage?

When it comes to paying back a reverse mortgage, you are not required to make any regular monthly payment. You only need to pay back your loan and the interest that comes with it upon moving out of your home or when you decide to sell it. In the event of death, the estate will be responsible to repay the reverse mortgage. Once the home is sold, then the principal and interest will be due to be paid back by the borrower. In the event of the borrower’s passing, the estate would be responsible for paying back the loan and interest.

You should be aware of the rights that you have as the borrower should you wish to pay back your reverse mortgage early. There may be some fees associated with it. You can also refinance your reverse mortgage or get a new mortgage as you age and become eligible to higher loan amounts based on increased loan to value and/or the increase of value of your home. Your mortgage broker has the right tools that can help you plan for these steps ahead of time.

Which lenders offer reverse mortgages?

Here at 911 Mortgage Brokers – The Mortgage Centre we work with the two main lenders that offer reverse mortgages: Home Equity Bank and Equitable Bank. Since Home Equity Bank is one of the largest and most well-known providers of reverse mortgages in Ontario, their “CHIP mortgage” is often synonymous with a reverse mortgage. However, Equitable Bank has equally competitive reverse mortgage products for seniors. Each lender has its own qualifying criteria, interest rates and terms and conditions.

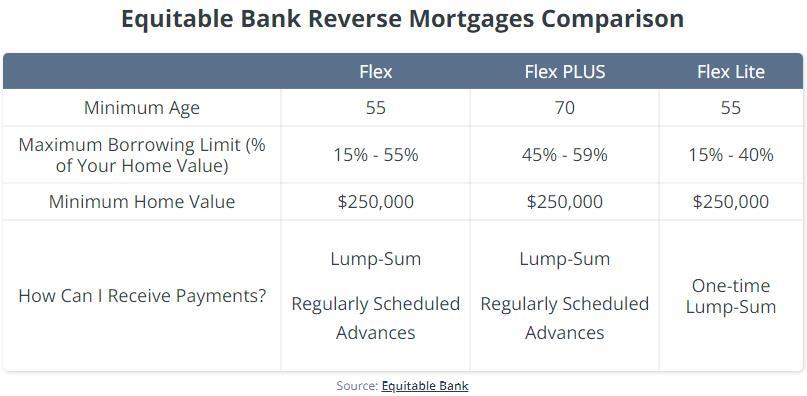

Equitable Bank Reverse Mortgages

Equitable Bank offers reverse mortgages to most major cities and towns in Ontario, British Columbia, Quebec, and Alberta. To qualify for an Equitable Bank reverse mortgage, you will need to be at least 55 years of age and have a home that has an appraised value of at least $250,000.

Equitable Bank offers three different types of reverse mortgages: FLEX, Flex PLUS, and Flex Lite. Each has different eligibility requirements or maximum lending limits. The Reverse Mortgage Flex is Equitable Bank’s original reverse mortgage and is suitable for most homeowners looking for a reverse mortgage.

The Flex Lite is for homeowners that might not want to borrow as much money. In return for a lower borrowing limit, Flex Lite borrowers will have a lower interest rate, with them currently being the best reverse mortgage rates in Canada. However, Flex Lite also only allow for a single lump-sum advance at the beginning of your term, which means that you won’t be able to schedule regular advances. For homeowners that want a higher borrowing limit, the Flex PLUS reverse mortgage grants a higher maximum limit but comes with a higher reverse mortgage rate and age requirement.

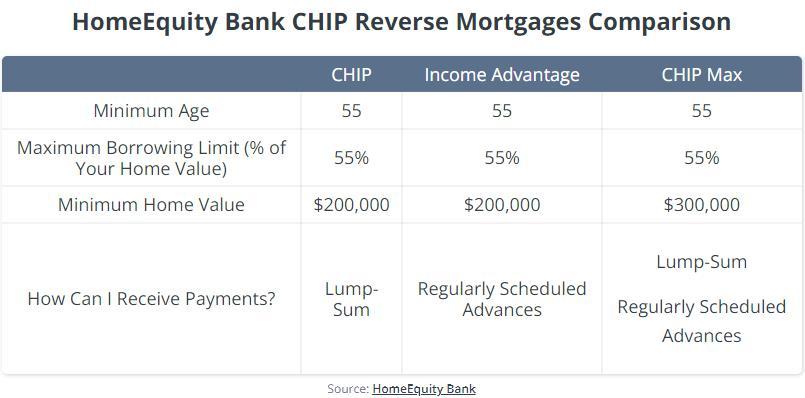

Home Equity Bank “CHIP” Reverse Mortgages

CHIP Reverse Mortgages are offered by Home Equity Bank. Originally called the Canadian Home Income Plan, CHIP provides a source of tax-free income for those over the age of 55, and was Canada’s original reverse mortgage product. Home Equity Bank reverse mortgage offerings include CHIP, CHIP Max, CHIP Open, and Income Advantage.

What are the interest rates on reverse mortgages?

How 911 Mortgage Brokers can help

Here at 911 Mortgage Brokers – The Mortgage Centre we understand the needs of Canadian seniors and we take pride in assisting them in achieving their financial and lifestyle goals.

As our 911 Mortgage Brokers are experts in reverse mortgages, they will make the process of applying for a reverse mortgage smooth and stress free. In some cases it can take a third of the time to get approved and funded for a reverse mortgage when compared to the average bank mortgage. We will take the time to understand your own particular financial needs to obtain a reverse mortgage that fits your family’s lifestyle so you can enjoy your retirement years. With the right Reverse Mortgage solution, we can even help you achieve some of the dreams you had reserved for your retirement earlier than expected.

Whether you are looking to pay off any other debt without selling your home, have extra cash to fund your retirement and have a sense of financial security, to access cash to purchase new luxury items and live the high-life, or help other family members who you love with their needs, we will help you plan for success.

The first step is to contact us so we can discuss your current financial situation as well as your goals and expectations as you go into retirement. We have access to over 50 different mortgage lenders and access to multiple reverse mortgage lenders. So even if a reverse mortgage is not right for you, we can help you determine what mortgage solution works best for your needs.

If we determine that a new reverse mortgage is not the right option for you, we will help you apply for a more suitable mortgage that better suits your needs and works for your situation. Here at 911 Mortgage Brokers – The Mortgage Centre we have the right tools and lender connections to bridge you and your family successfully into retirement.

Depending on your current financial situation as a senior (and the type of mortgage product you need), your 911 Mortgage Broker or agent will help you identify what documentation will be needed to process your mortgage and we will explore your mortgage options with you.

Our Service Areas

911 Mortgage Brokers – The Mortgage Centre offers services to clients across Toronto and the GTA, Vaughan, King, Aurora, Stouffville, Newmarket, Markham, Richmond Hill, Barrie, Innisfil, Orillia, Collingwood, Oshawa, Ajax, Whitby, Mississauga, Brampton, Caledon, Burlington, Oakville, Milton, Bolton, Hamilton, St. Catherines, Niagara Falls, Windsor, Kitchener, Waterloo, London, as well as far as Muskoka cottage country, Ottawa, Simcoe, and the rest of Ontario.

Call Us Today at 289-318-0911 or Toll Free at 1-888-377-0911 for a Free No-Obligation Mortgage Pre-Approval consultation.