What's your Credit Score?

What is a Credit Score?

A credit score is a three-digit number, typically between 300 and 850, designed to represent your credit risk, or the likelihood you will pay your bills on time.

There are two main credit bureaus in Canada – Equifax and TransUnion – that collect, store, and share information about how you use credit.

Credit scores are calculated using information in your credit reports, including your payment history, the amount of debt you have, and the length of your credit history. Higher scores mean you have demonstrated responsible credit behavior in the past, which may make potential lenders and creditors more confident when evaluating a request for credit.

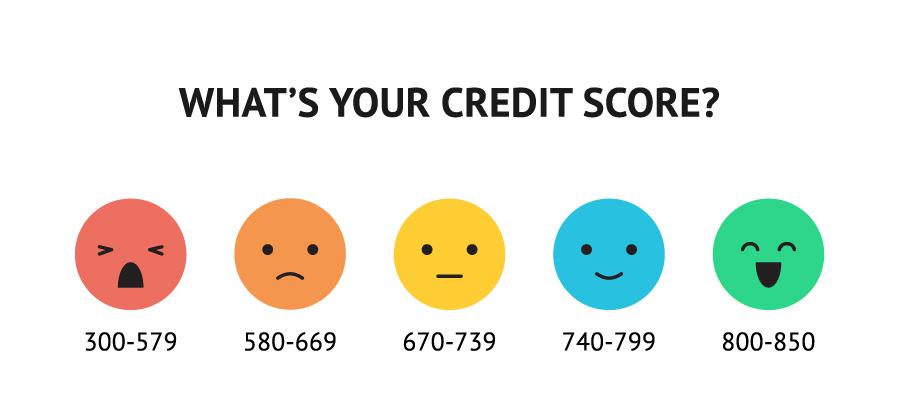

Credit score ranges vary based on the credit scoring model used, but are generally similar to the following:

- 300-579: Poor

- 580-669: Fair

- 670-739: Good

- 740-799: Very good

- 800-850: Excellent

There are many different scoring models, and some use other data, such as your income, when calculating credit scores. Credit scores are used by potential lenders and creditors, such as banks, credit card companies or car dealerships, as one factor when deciding whether to offer you credit, like a loan or a credit card.

Why are credit scores important?

Why is it important to strive for a higher credit score? Simply put, those with higher credit scores generally receive more favorable credit terms, which may translate into lower payments and less paid in interest over the life of the account.

Remember, though, that everyone’s financial and credit situation is different. Different lenders may also have different criteria when it comes to granting credit, which may include information such as your income.

The types of credit scores used by lenders and creditors may vary based on their industry. For example, if you’re buying a car, an auto lender might use a credit score that places more emphasis on your payment history when it comes to auto loans.

Credit scores may vary according to the scoring model used, and may vary based on which credit bureau furnishes the credit report used for the data. That’s because not all creditors report to all three nationwide credit bureaus – Equifax, Experian and TransUnion. Some may report to only two, one or none at all. In addition, lenders may also use a blended credit score from the three nationwide credit bureaus.

One of the benefits of using a mortgage broker is that we use one single credit “pull” to review your credit report, whereas if you go to three different banks on the street, each one of them will be asking you for a separate credit check which may lower your credit score. Furthermore, major banks tend to be pretty cut-throat when it comes to reviewing credit scores and will not hesitate to decline/reject a borrower just by doing a quick credit check.

Why Work with 911 Mortgage Brokers

Here at 911 Mortgage Brokers – The Mortgage Centre, we know that a number does NOT define a person. We take more of a wholesome approach and we take into consideration all factors of your personal and financial situation, not just your credit score.

Our mission here at 911 Mortgage Brokers – The Mortgage Centre, is to assist all home buyers and home owners, regardless of their age, income, or credit score, so we take a more common sense approach.

If you are unsure where you stand on your credit score, or how it will affect your mortgage application, contact us for a free mortgage consultation. Our experienced 911 Mortgage Brokers will analyze your credit report and give you personalized advice. Furthermore, as we work with a large pool of lenders including traditional Banks, Credit Unions, Alternative Mortgage Lenders, Mortgage Investment Corporations, and Private Lenders, we can explore your mortgage options and help you decide on the best mortgage solution.

Whether it is a mortgage for home purchase, a mortgage renewal, a refinance, a home equity loan, a home equity line of credit, a second mortgage or a private mortgage, we have the tools, know-how and more than 50 lenders nationwide ready to help you fund your mortgage or loan option.

Call Us Today at 289-318-0911 or Toll Free at 1-888-377-0911 for a free confidential consultation to discuss your options.

Our Service Areas

911 Mortgage Brokers – The Mortgage Centre offers services to clients across Toronto and the GTA, Vaughan, King, Aurora, Stouffville, Newmarket, Markham, Richmond Hill, Barrie, Innisfil, Orillia, Collingwood, Oshawa, Ajax, Whitby, Mississauga, Brampton, Caledon, Burlington, Oakville, Milton, Bolton, Hamilton, St. Catherines, Niagara Falls, Windsor, Kitchener, Waterloo, London, as well as far as Muskoka cottage country, Ottawa, Simcoe, and the rest of Ontario.

Source: https://www.equifax.com/personal/education/credit/score/what-is-a-credit-score/